Product introduction

Easy Pay provides consumers with a frictionless payment experience within the merchant app, which greatly shortens the payment path. Consumers can enable one-click payment during their first-time payment without being redirected to the Mobile Payment Provider (MPP) app for authorization. After the one-click payment is enabled, the merchant can deduct funds from the consumer's account by using an access token for subsequent transactions.

Basic concepts

Terms (Abbreviations) | Definition |

Access token | Security credentials with login session that identifies user, user's group, user's permissions, and, in some cases, specific applications. Access Token can be used for payment. |

Acquiring Service Provider (ACQP) | An Acquiring Partner participating in Alipay+ Core or other acquirer cooperating with a member of Ant Group to enable payments. |

Consumer | An individual or institution that uses the payment service. |

Merchant | A person that enters into a Transaction with a User which is acquired by an Acquiring Service Provider or an Indirect Acquiring Service Provider, as applicable. |

Mobile Payment Provider (MPP) | A Mobile Payment Provider participating in Alipay+ Core or other user- or issuer-facing payment service provider cooperating with a member of Ant Group to enable payments. |

User experience

The following figure illustrates the user experience for the first-time payment and subsequent payments on the merchant app, WAP page, and website.

First-time payment

During the first-time payment, the consumer completes the authorization process to pay and enable one-click payment for subsequent transactions.

App

In this scenario, the consumer makes a payment and enables one-click payment for future use on the merchant app during the entire payment process.

Figure 1: Payment process on the merchant app

The consumer performs the following steps to complete the payment and enable one-click payment.

- The consumer selects a payment method and proceeds to check out on the merchant page.

- A confirmation page displaying the consumer's MPP account information pops up, and the consumer confirms the account information to continue.

- An SMS verification code is sent to the consumer's mobile. The consumer enters the verification code to enable one-click payment and make the payment.

- The payment result page is presented to the consumer.

WAP page

In this scenario, the consumer makes a payment and enables one-click payment for future use on the merchant WAP page during the entire payment process.

Figure 2: Payment process on the merchant WAP page

The consumer performs the following steps to complete the payment and enable one-click payment.

- The consumer selects a payment method and proceeds to check out on the merchant page.

- A confirmation page displaying the consumer's MPP account information pops up, and the consumer confirms the account information to continue.

- An SMS verification code is sent to the consumer's mobile. The consumer enters the verification code to enable one-click payment and make the payment.

- The payment result page is presented to the consumer.

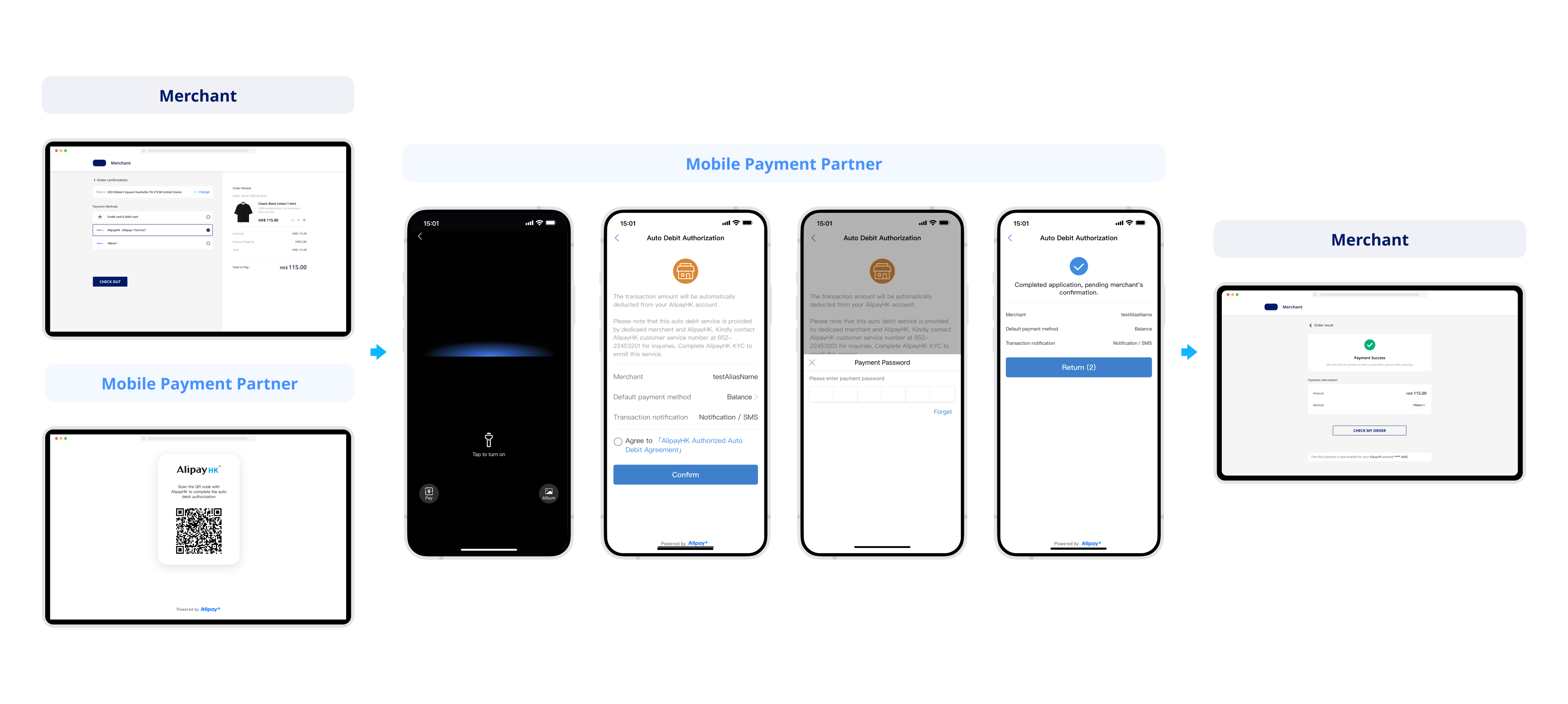

Web

In this scenario, the merchant redirects the consumer to the Mobile Payment Provider (MPP) to complete the payment and enable one-click payment.

Figure 3: Payment process on the merchant Web page

The consumer performs the following steps to complete the payment and enable one-click payment.

- The consumer selects a payment method and proceeds to check out on the merchant page.

- The QR code of the MPP account is presented to the consumer.

- The consumer scans the QR code with the MPP app, signs the agreement, and enters the payment password to make the payment and enable one-click payment.

- The payment result is presented to the consumer on the merchant Web page.

Subsequent payment

Subsequent payments can be made without the password after the consumer enables the one-click payment in the first-time payment. This section introduces the user experience of subsequent payments.

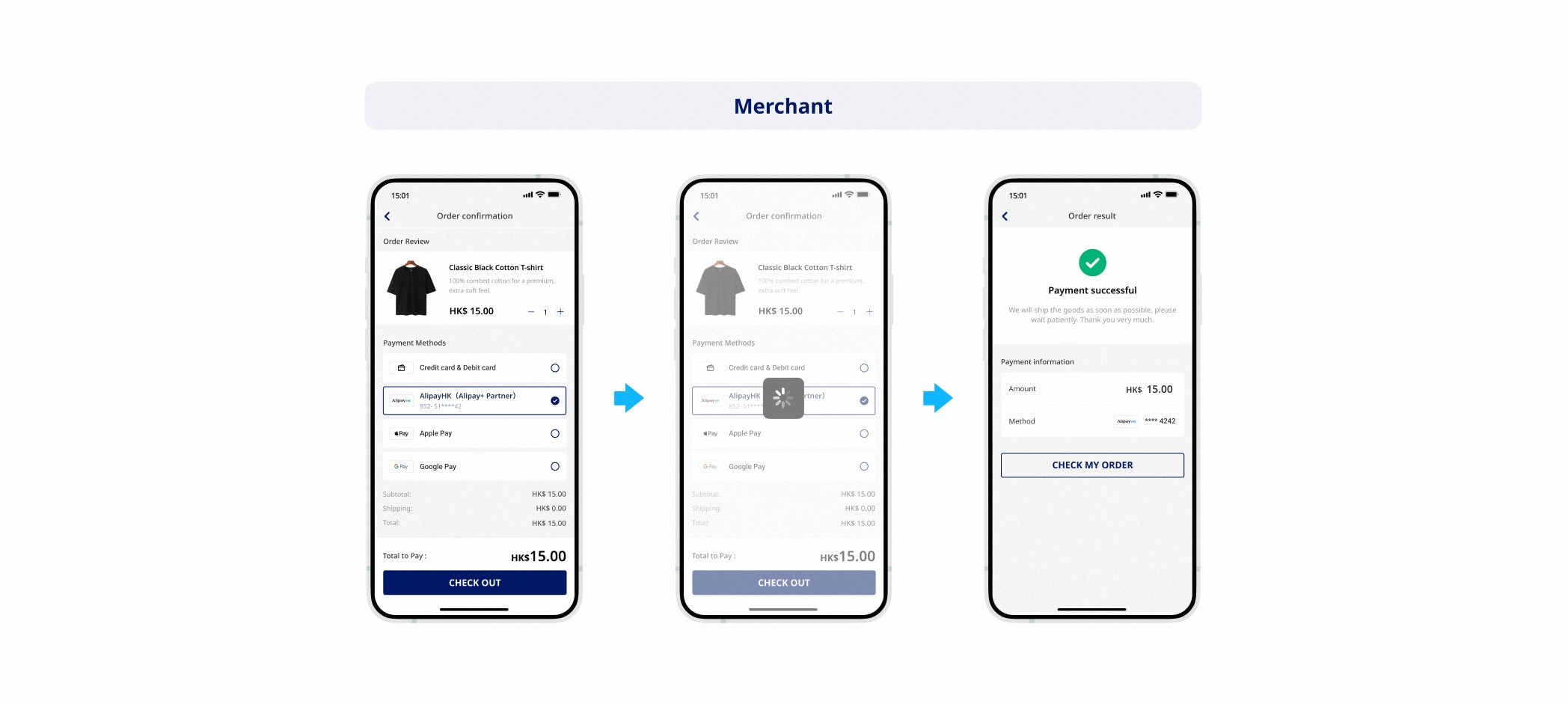

App

Figure 4: One-click payment on the merchant app

WAP page

Figure 5: One-click payment on the merchant WAP page

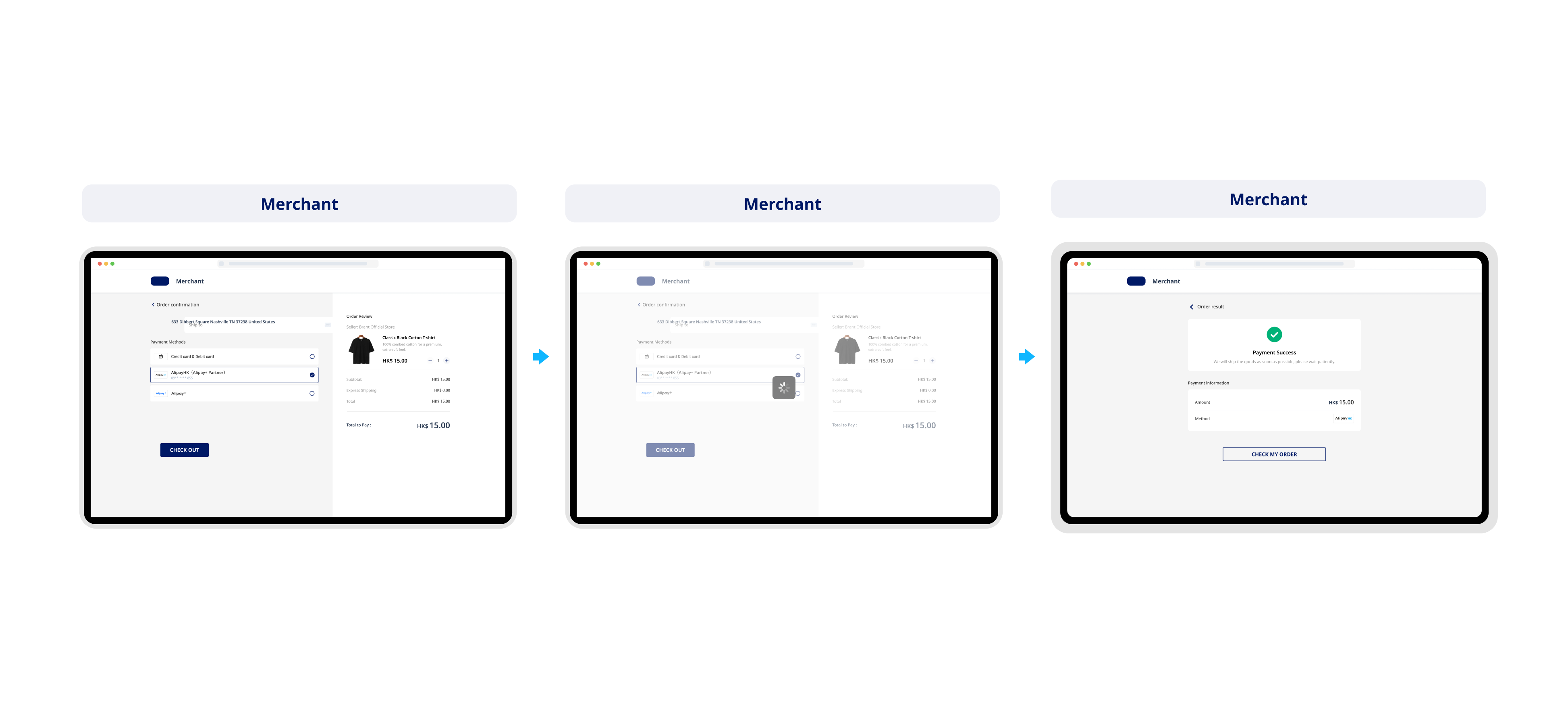

Web

Figure 6: One-click payment on the merchant Web page

Product functionalities

Alipay+ Easy Pay offers the following main features to facilitate your business:

User authorization

The following functionalities related to user authorization are provided:

- Authorization: Consumers can authorize the merchant to deduct funds from the consumer's MPP account by binding the MPP account to the merchant.

- Revocation: Consumers can unbind the MPP accounts so they can no longer be used for one-click payment. The unbinding can be initiated on the merchant side or the MPP side.

- Authorization/revocation result notification: When the MPP confirms that the binding/unbinding is successful, Alipay+ actively pushes the binding/unbinding result to the ACQP, who can then relay the result to the merchant accordingly.

Payment

One-click payment: Once authorized, the merchant is granted an access token, with which the merchant can safely deduct funds from the consumer's bound MPP account.

Post payment

The following functionalities related to the processes after payment are provided:

- Payment result inquiry: The MPP can send the payment result to Alipay+ on Alipay+'s inquiry about the payment status.

- Payment result notification: When the MPP confirms that the payment is successful, Alipay+ actively pushes the payment result to the ACQP, who can then relay the result to merchants.

- Refund & cancellation: Consumers can refund or cancel a payment made with the bound account.

Business operations

The following functionalities related to business operations are provided:

- One-stop settlement: Alipay+ provides a unified funds clearing and settlement service for the MPPs. Instead of mutual settlement, the MPPs only need to settle with Alipay+, which greatly simplifies the funds processing and improves the settlement efficiency.

- Alipay+ Partner Workspace: Alipay+ Partner Workspace is a platform where the MPPs can execute operational tasks related to the Alipay+ business, which includes transaction management, risk management, account management, dispute handling, and integration.

- Agreement management: Alipay+ provides or helps the MPPs build a module where the consumers can view and manage agreements and authorizations. This module boosts consumers' sense of security for Easy Pay.