Alipay+ Tax Refund introduction

Alipay+ Tax Refund enables travelers to get the paid Value-added Tax (VAT) refunded quickly after tax-free shopping.

Alipay+ Tax Refund uses Original Credit Transaction (OCT), which can be initiated by the tax refund service providers or their Acquiring Service Providers (ACQPs), and credits the user's account. Through this product, tax refund service providers can directly credit the refunded tax to the balance account of the traveler's Alipay+ wallet.

Applicable scenarios

Business scenario | Description | Supported or not |

Airport/port Tax Refund | Customers can obtain the tax refund at airports or ports upon their departure after getting approval from customs. | Yes |

Downtown Tax Refund | Customers can obtain the tax refund in advance before their departure as long as guarantees are provided. | Coming soon |

Basic concepts

Term (Abbreviation) | Definition |

Acquiring Service Provider (ACQP) | An Acquiring Partner participating in Alipay+ Core or another acquirer cooperating with a member of Ant Group to enable payments. |

Alipay+ | Alipay+ solution is a collaborative effort along with all partners to provide more open, digitalized, and inclusive financial services to worldwide consumers and merchants. |

Merchant | A person that enters into a Transaction with a User which is acquired by an Acquiring Service Provider or an Indirect Acquiring Service Provider, as applicable. For Alipay+ Tax Refund, a merchant is usually a tax refund service provider. |

Mobile Payment Provider (MPP) | A Mobile Payment Partner participating in Alipay+ Core or other user-facing or issuer-facing payment service provider cooperating with a member of Ant Group to enable payments. For Alipay+ Tax Refund, an MPP is usually a wallet. |

Original Credit Transaction (OCT) | The transfer of a tax refund amount from a merchant to the balance account of a user that is routed, cleared, and settled through Alipay+ Core. |

User experience

Alipay+ Tax Refund provides a scan-to-refund experience, which is fast and convenient. See the following figure for the user experience:

Figure 1. Get refunded with Alipay+ Tax Refund

The user completes the following steps to refund via Alipay+ Tax Refund:

- (Prerequisites) The user has completed the departure procedures at Customs and has the tax refund form verified by the tax refund service provider.

- The user selects Alipay+ as the refund method at the refund point of the tax refund service provider. The tax refund service provider then displays guidance about how to open the Alipay+ tax refund code on the refund counter/terminal.

- The user opens the wallet app to scan a QR code and then the Alipay+ tax refund code is directly rendered in the wallet app.

- After scanning the Alipay+ tax refund code successfully, the tax refund service provider displays the estimated tax refund amount on the refund confirmation page at the refund counter/terminal.

- The user confirms the refund amount to get refunded.

- The refund succeeds. The tax refund counter/terminal displays the refund success page. The user can check the refund in the transaction history of the wallet app, and receive notifications of the successful tax refund via SMS, in-app notifications, or other methods.

Notes:

- Users do not need to provide any refund-method information on the tax refund form. They can just select Alipay+ as the refund method at the tax refund point to use Alipay+ Tax Refund.

- In Step 3, the user can directly invoke the Alipay+ tax refund code from the tax refund homepage of the wallet app instead of by scanning the QR code.

Product functionalities

Alipay+ Tax Refund offers the following main features to facilitate your business:

- Account verification: After scanning the Alipay+ tax refund code, the tax refund service provider can request to verify the user's account to ensure that the account is valid. Alipay+ returns both the verification result and the actual tax refund amount. The actual tax refund amount is in the currency of the user's balance account and is calculated with the current FX rate adopted by Alipay+. The user can decide whether or not to continue the refund according to the returned tax refund amount.

- Real-time tax refund: The user can receive the tax refund to the balance account of the user's Alipay+ wallet in real time.

- Synchronizing the refund result: In addition to the synchronous result from the tax refund API, the MPP can also use the inquiry API or the notification API to send the refund result.

How it works

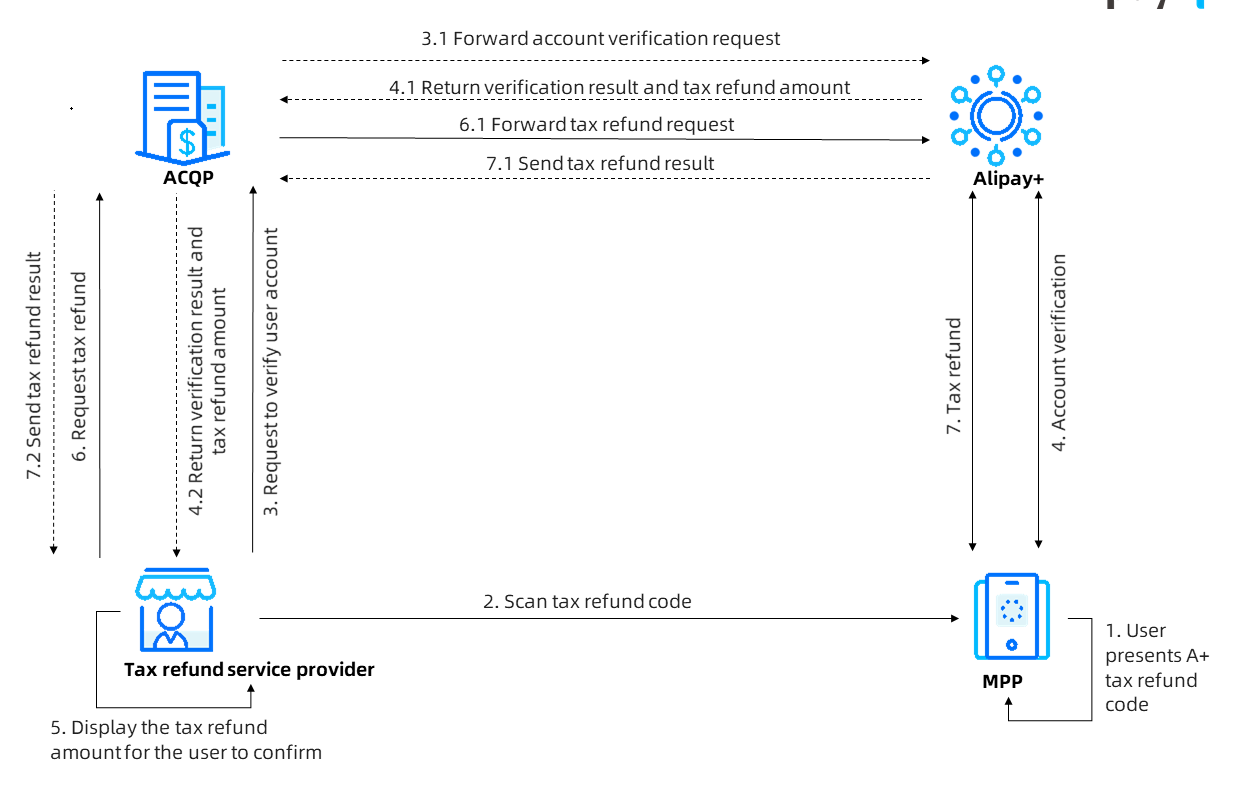

See the following figure to learn about the workflow of Alipay+ Tax Refund.

Figure 2. Alipay+ Tax Refund workflow

Alipay+ Tax Refund workflow contains the following steps:

- The user presents the tax refund code to the tax refund service provider (Step 1).

- The tax refund service provider scans the code and sends an account verification request to Alipay+ via the ACQP (Steps 2-3.1).

- Alipay+ handles the verification request with the wallet and then returns the account verification result and the tax refund amount to the tax refund service provider via the ACQP (Steps 4-4.2).

- The tax refund service provider displays the estimated tax refund amount to the user and the user accepts the tax refund (Step 5).

- The tax refund service provider sends the tax refund request to Alipay+ via the ACQP (Steps 6-6.1).

- Alipay+ handles the tax refund request with the wallet and then returns the tax refund result to the tax refund service provider via the ACQP (Steps 7-7.2).

Get started

Go through the sections below to obtain more information that empowers your integration with the Alipay+ Tax Refund:

- For detailed information about how to integrate the functionalities, see Integration guide.

- When using APIs to integrate, you need to take the following things into consideration:

- Make a POST request to the corresponding address with the identity information, signature, and business parameters in the HTTP request. For more information about the structure of a request and response, see API overview.

- To ensure message transmission security, the ACQP must sign a request and validate the signature properly. When calling an Alipay+ API, the ACQP must sign the API request and validate the response signature accordingly; when receiving an API call from Alipay+, the ACQP must validate the request signature and sign the API response accordingly.

- For instructions about how to reconcile the transactions and settlements, see Reconcile.

- For more specifications for the Alipay+ Tax Refund process, see Alipay+ Code-Scanning Payment Standards.