Support Alipay+ marketing activities

To increase transactions between the Mobile Payment Provider (MPP) and the merchant or Acquiring Service Provider (ACQP), Alipay+ provides marketing activities that users can apply during the payment.

To support Alipay+ marketing activities, the MPP needs to handle marketing information and support Alipay+ in performing risk evaluation for the payment with promotion.

Handle marketing information

The MPP needs to handle marketing information in the following scenarios:

- Payment with promotion

- Refund for the payment with promotion

- Displaying marketing information

Note:

- The promotion currency is converted to the MPP currency.

- A single payment may include multiple promotions, and the MPP must display all the applied promotions on the transaction detail page.

Payment with promotion

When marketing activities are involved in payment transactions, Alipay+ forwards the promotion information to the MPP and specifies the amount that is saved for the user.

- In the User-presented Mode Payment and Auto Debit scenarios, the promotion information is specified by the paymentPromoInfo parameter when the MPP receives the pay API request. See the pay API for details.

- In the Merchant-presented Mode payment and Cashier Payment scenarios, the promotion information is specified by the paymentPromoInfo parameter when the MPP receives the userInitiatedPay API response. See the userInitiatedPay API for details.

Refund for the payment with promotion

When a refund is initiated for a payment made with promotion, all the applied promotion is specified by the refundPromoInfo parameter. Alipay+ calculates the refund amount, and the MPP needs to display the promotion information on the refund result page. See the refund API for details.

Displaying marketing information

See the following links about how to display marketing information at the MPP side:

- In the Cashier Payment scenario, see Page detail requirements for details.

- In the Auto Debit scenario, see Transaction Detail Page for details.

- In the User-presented Mode Payment scenario, see Transaction Detail Page for details.

- In the Merchant-presented Mode Payment scenario, see Page detail requirements for details.

Perform risk evaluation

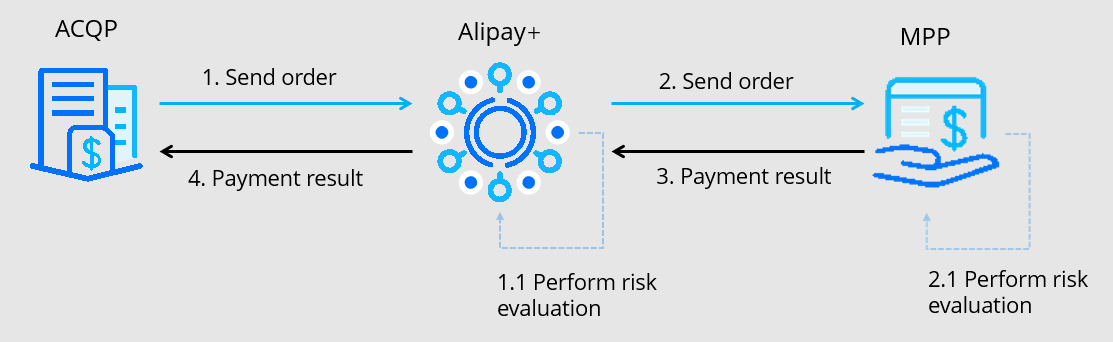

The MPP needs to support Alipay+ in performing risk evaluation for the payment with promotion, and Alipay+ recommends the MPP take its risk control measures. The following figure illustrates the process:

Figure 1. Risk control process

Support Alipay+ risk evaluation

Alipay+ uses the unique customer ID obtained from the MPP to conduct risk evaluation. The method for obtaining the unique customer ID differs among payment scenarios:

- In the Cashier Payment and Merchant-Presented Mode Payment scenarios, the MPP needs to send the unique customer ID in the userInitiatedPay API request.

- In the Auto Debit scenario, the MPP needs to return the unique customer ID in the applyToken API response.

- In the User-presented Mode Payment scenario, the MPP needs to send the unique customer ID in the getPaymentCode API request.

Perform risk control by the MPP (Recommended)

Alipay+ recommends the MPP take its risk control measures with the following basic risk control strategies and actions:

Risk control strategies:

- Reject payments associated with promotion abuse, gambling, or bad user credit.

- Reject payments where the location of the user's mobile app is inconsistent with that of the merchant's store in the offline payment scenarios.

- Reject payments made by a mobile app that is maliciously modified, or by a tampered device such as an emulator or a rooted device.

- Reject payments made by the device that is logged in by three or more MPP accounts in recent 24 hours.

Actions:

- If Alipay+ detects any risk, the MPP helps to investigate and communicate the result with Alipay+.

- The MPP updates the risk control strategies accordingly if the marketing activities have specific requirements.