Transaction Processing

You can first gain an overview of the roles involved in the payment process of consumer-presented mode. You can then see the detailed procedures of transaction processing that are illustrated by two typical scenarios.

Roles overview

The following figure illustrates how different roles are involved in the payment process of consumer-presented mode (CPM). A consumer presents a consumer-presented code (CPC) that is generated on an e-wallet app. A merchant scans the CPC and forwards the transaction to the code issuer for transaction authorization via one or more intermediaries which may include ISVs, Acquirers and Switches. In the process, transaction is forwarded by the intermediaries who follow the code issuer table to determine the receiver.

Figure 6 Roles in the payment ecosystem of consumer-presented mode

A detailed explanation on each role is given below:

Consumer: A consumer who opens an e-wallet app and to make payment of goods or services from a merchant;

App: An e-wallet application that is provided by an Digital Wallet to its users, through which payment is made from a consumer to a merchant.

Merchant: A merchants who provides goods or service to a consumer and get paid by the consumer.

ISV: Independent software vendor who provides acquiring service to merchants.

Acquirer: An institution that processes payments on behalf of merchants.

Switch: A payment switch that routes transactions.

Code Issuer: An Digital Wallet who issues codes and authorizes payment by providing digital wallet apps to its users.

Typical scenarios

Below are two typical scenarios where transaction is processed according to the code issuer table. Depending on the different connection scenarios, two typical scenarios of transaction processing are demostrated below:

- Acquirer directly connected with code issuer

- Acquirer and code issuer both connected with a payment switch

Note: Please be noted that the code values are examples only.

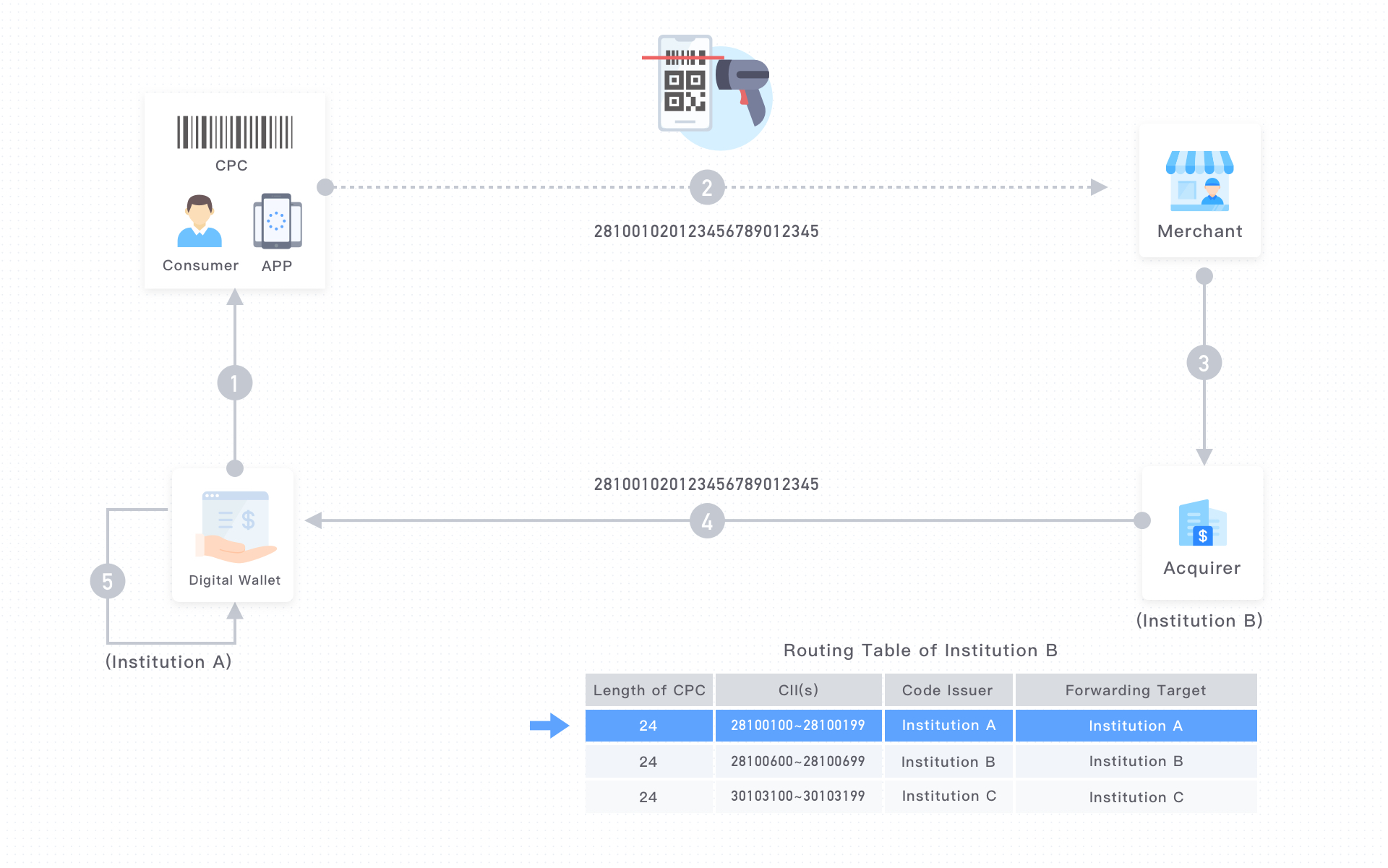

Acquirer directly connected with code issuer

The following diagram illustrates the transaction processing for acquirers who are directly connected with code issuers:

Figure 7 Acquirer directly connected with code issuer

- A consumer opens an app and presents a barcode or QR code, which is issued by Institution A with a code value of 281001020123456789012345, to a merchant.

- The merchant reads the code value by scanning the barcode or QR code.

- A payment request is generated according to the code value and other transaction information; and the payment request is forwarded to the merchant's acquirer.

- The acquirer checks the combination rules of the 24-digit CPC, which is formatted by an 8-digit code issuer ID (CII) and a 16-digit consumer identification number (CIN); the acquirer then extracts the 8-digit CII 28100102, and looks up the code issuer table to identify the code issuer; the acquirer forwards the transaction to the corresponding code issuer in the table, institution A.

- Institution A recognizes that the 24-digit CPC starting with 28100102 is its own CII.

Now institution A is able to retrieve user account information from its back-end system via Consumer Identification Number, and complete the subsequent processes.

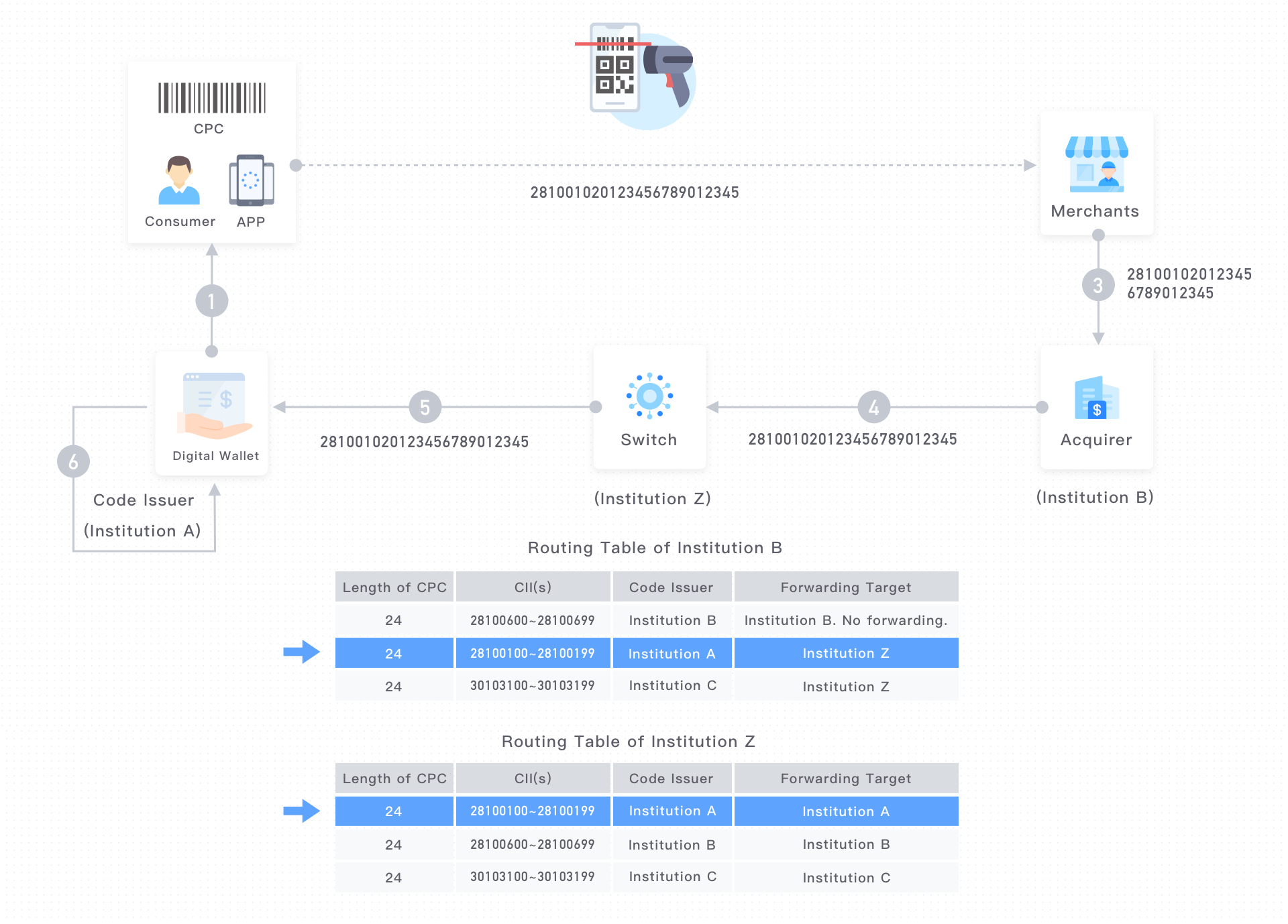

Acquirer and code issuer both connected with a payment switch

The following diagram illustrates a transaction processing for acquirers who are connected via a payment switch with code issuers:

Figure 8 Acquirer and code issuer both connected with a payment switch

- A consumer opens an app and presents a barcode or QR code, which is issued by Institution A with, for example, a 24-digit code value of 281001020123456789012345.

- The merchant reads the code value by scanning the barcode or QR code.

- A payment request is generated according to the code value and other transaction information; and the payment request is forwarded to its acquiring service provider, institution B.

- The acquirer (institution B) checks the combination rules of the 24-digit CPC, which is formatted by an 8-digit CII and a 16-digit CIN; the acquirer (institution B) then extracts the 8-digit CII 28100102, and looks up the code issuer table to identify the code issuer; the acquirer (institution B) forwards the transaction to institution Z who can switch the transactions for the corresponding code issuer in the table, institution A.

- Institution Z checks the combination rules of the 24-digit CPC, which is formatted by an 8-digit CII and a 16-digit CIN; institution Z then extracts the 8-digit CII 28100102, and looks up the code issuer table to identify the code issuer; So institution Z forwards the transaction to the corresponding code issuer in the table, institution A.

- Institution A finds out that the 24-digit CPC starting with 28100102 is its own CII. Now institution A is able to retrieve user account information from its back-end systemand complete the subsequent processes.